20 Mar Pilot Pricing, Reviews and Features April 2023

Contents:

Their solution aims to replace your existing bookkeeping efforts. With Botkeeper’s Partner Platform, you have the ability to onboard and manage all of your clients through a custom white-labeled portal. Free to get started, easy to add your whole sales team, commit to monthly or annual plans. Leap the Pond- AcctTwo is focused on delivering the future of finance and accounting to our customers. Kathy Haan, MBA is a former financial advisor-turned-writer and business coach. For over a decade, she’s helped small business owners make money online.

Once your dedicated bookkeeper finishes the checklist and review process, they’ll email you to tell you that the bookkeeping process has been completed. You can immediately see all the changes they made in your QuickBooks Online account. Before the formal bookkeeping process begins, Pilot will onboard clients to introduce the bookkeeping software and show how the process works. The onboarding process will also help Pilot experts know what to expect and what needs to be done.

The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content. Although Pilot allows you to completely outsource your bookkeeping, there’s no doubt that these fees are significant and may be more than some small businesses can afford. Pilot can help you transition your books from Xero as part of the onboarding process, but all of its bookkeeping is done in QuickBooks. The accounting integration works well once defined but also gives the sense that is a little bit blind, so you need to continuously take a look at the integrations made, so you cannot trust 100%.

Automatic Review

She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. A summary of your overall impressions, and if you would recommend this product or service. Know their technology stack, contract renewal date, top decision-makers, hiring trends, and top company news in one place.

However, while it has useful outstanding checks, such as Reviewbot, an artificial intelligence tool that flags missing or inaccurate transactions, it doesn’t provide payroll services and cash-basis accounting. We reviewed multiple accounting software options using a detailed methodology to help you find the 10 best online bookkeeping services for small businesses. Our ratings considered everything from pricing and customer reviews to the number and quality of features available and what our panel of experts thought about the services available. Its bookkeeping service comes with its Enterprise plan, which costs $399 per month when billed annually. You’ll get a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports.

The Bookkeeping Master

Pilot can be a good choice for growing startups, but its monthly cost may be out of range for some small businesses. Keeping track of pilot balances via spreadsheets, handwritten invoices, or even QuickBooks has obvious limitations. SkyManager is a pilot-specific software that helps FBOs, flight clubs, and other organizations better manage receivables. Invoicing, account management, and collections are all processed within SkyManager. Pilot provides accurate bookkeeping each month saving you time and resources if you’re still doing it yourself.

- CPA firms are comprised of auditors who conduct both public and private audit engagements.

- With Pilot, you get paired with a dedicated bookkeeper and no longer have to worry about managing your bookkeeping on your own.

- Pilot announced crossing 1,000 customers in 2020, and was at roughly 1,700 at the end of 2022, with an average revenue per customer of around $25,000.

- On top of standard bookkeeping and reporting, Pilot includes burn-rate calculations and 20 special transactions per month — bills, invoices, checks and reimbursements — with the Core and Select plans.

- Pilot offers the best bookkeeping, tax, and CFO services for growing businesses.

Or maybe you’re just looking for someone to reconcile your accounts and prepare your financial statements. As with most types of software, the best online bookkeeping services offer many levels of security. FINSYNC’s mission, with innovative software and unmatched customer service, is to help small and mid-sized businesses succeed. Our payments platform allows businesses to centralize control over payments. We offer a complete solution for invoicing, bill payment, payroll, accounting, financing… Pilot customers in the Core bookkeeping package have limited support options.

Also see other Products/Services by Pilot in:

When you sign up for https://1investing.in/, you’ll be assigned a dedicated bookkeeping expert who’ll serve as your point of contact. They’ll walk you through how to integrate your existing processes and software with QuickBooks. If you have any questions, you can speak with your account manager through the QuickBooks portal or by email at no additional cost. Plans for Pilot Bookkeeping start at $599 per month for businesses with less than $30,000 in monthly expenses. If you want to upgrade to the Select plan at this level, your price starts at $849 per month.

IDOS enables real-time and accurate transaction processing and ensures that the data processed is available in real-time for every upstream reporting &… With this system, bookkeepers record transactions when the money has been deposited into the client’s bank account or charged to their bank or credit card. Project accounting is a type of managerial accounting oriented toward the goals of project management and delivery. While project accounting was traditionally used for large construction, engineering, and government projects, it has now expanded into several other sectors. It is commonly used by government contractors, where the ability to account for costs by contract can be a requirement for interim payments.

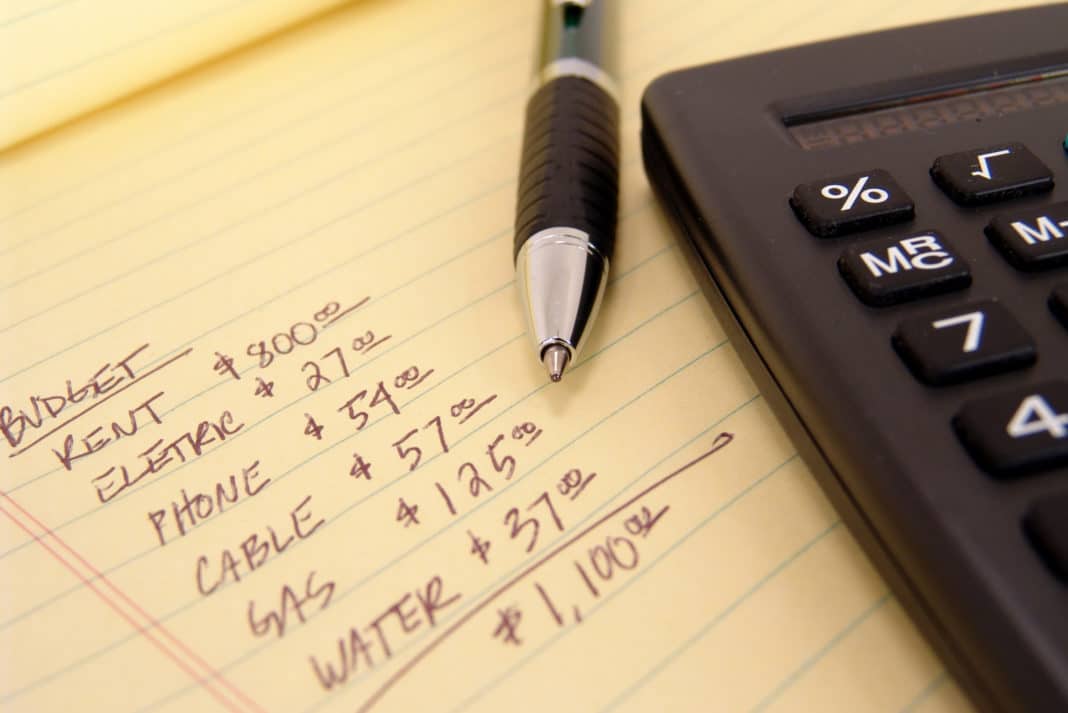

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Bookkeeping is an essential part of running a small business.

How To Choose an Online Bookkeeping Service

Reduce your bookkeeping costs and simplify your bookkeeping. Let us handle the bookkeeping while you focus on growing your business. To get started, answer a few questions about the business. Automatically import income and expenses, ensuring accurate reporting. If you’re unsure which method you should be using, it helps to consider your company’s growth plan for the future. If you’re approaching $25M in revenue or planning to IPO soon, then you should be using the accrual method and Pilot may be a better choice.

A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Pilot offers the best bookkeeping, tax, and CFO services for growing businesses. Brex recently purchased FP&A platform Pry, which overlaps with Pilot’s FP&A offering, and much of the manual categorization workflow around transactions happens in tools like Brex and Ramp today. Meanwhile, QuickBooks is the system of record and foundation that Pilot is built on.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. Ignite Spot Accounting is best for businesses who want bookkeepers who are certified in popular bookkeeping programs. We use dedicated people and clever technology to safeguard our platform. Sam has been looking after my small business accounts for a few years now. I haven’t had to deal with HMRC at all which is worth his fee alone.

Best 10 Accounting Services for Small Business – CEOWORLD magazine

Best 10 Accounting Services for Small Business.

Posted: Thu, 21 Jul 2022 07:00:00 GMT [source]

Multi-currency means using more than one currency in a multi currency bank account. Procurement or purchasing is the act of obtaining goods, supplies, and/or services. Therefore, project procurement is obtaining all of the materials and services required for the project. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in versus what is going out. On top of that, you need the data used in bookkeeping to file your taxes accurately. Bookkeeper360 is best for businesses that occasionally need bookkeeping services as well as those that want integrations with third-party tools. Pilot offers a range of financial services for startups and small businesses.

When you work with Pilot, you’re paired with a dedicated finance expert who takes the bookkeeping work off your plate. Xero is a free cloud-based online accounting software aimed at small and midsize businesses – it offers an easy way to handle your transactions and run your business. Some bookkeeping services can provide a full suite of bookkeeping, accounting and tax services.

Sorry, the comment form is closed at this time.